Expert Tips for Navigating Business Credit During Economic Uncertainty

Understanding Business Credit

In times of economic uncertainty, maintaining a solid business credit profile becomes crucial. Business credit is the ability of a company to obtain products or services on deferred payment terms, making it an essential tool for managing cash flow and securing financing. A strong credit profile can lead to better interest rates and favorable terms from suppliers.

Why Economic Uncertainty Impacts Business Credit

Economic instability often leads to tighter credit conditions, making it more challenging for businesses to secure loans or lines of credit. Financial institutions become more cautious, scrutinizing credit profiles more thoroughly. As a result, it's imperative for businesses to actively manage and improve their credit standing during these times.

Tips for Navigating Business Credit

Regularly Monitor Your Credit Report

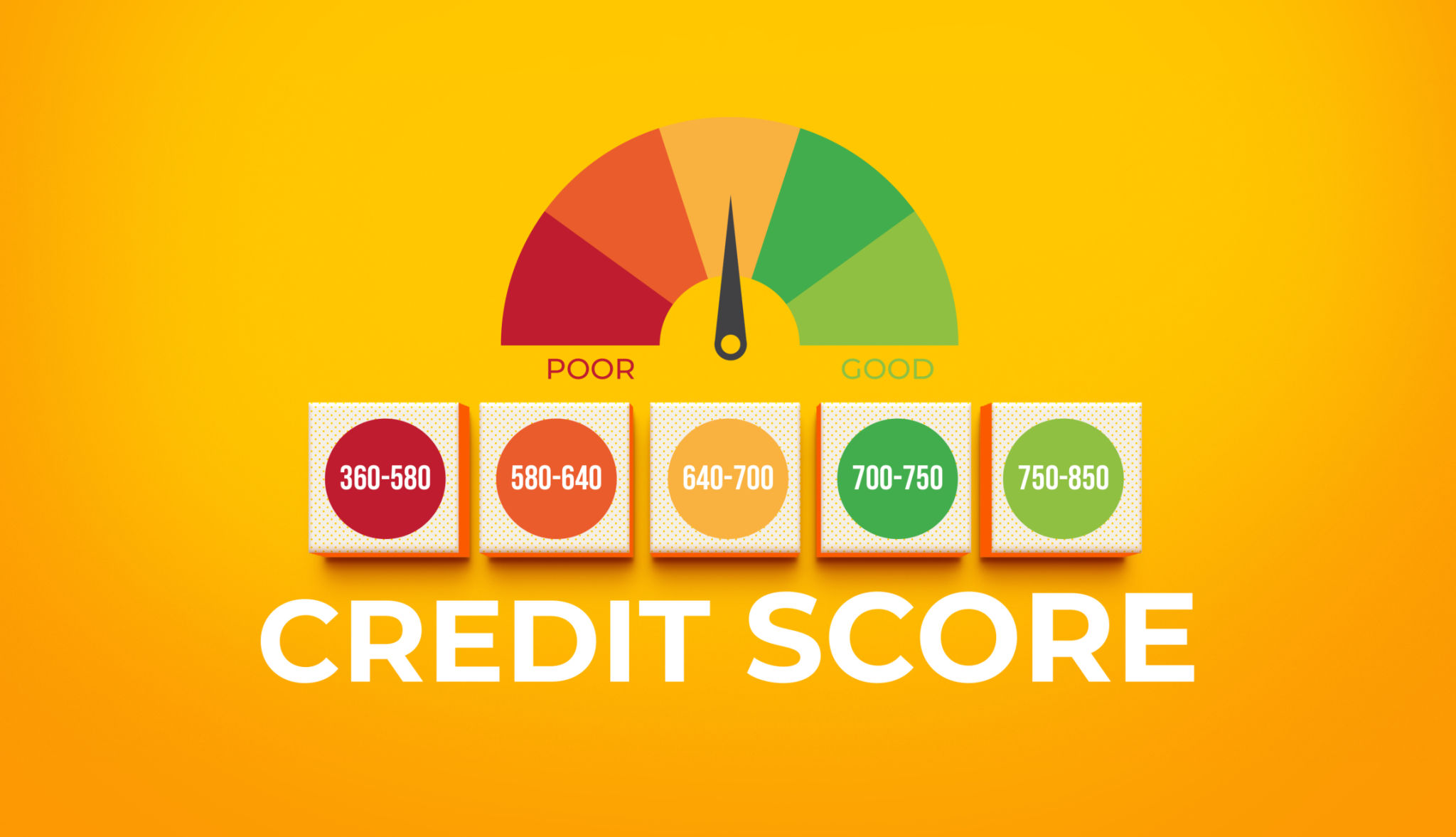

One of the first steps in navigating business credit is regularly monitoring your credit report. Keeping an eye on your credit score and understanding the factors that impact it can help you anticipate challenges. Look for inaccuracies or signs of fraud that could negatively affect your creditworthiness.

Maintain Strong Financial Records

Accurate and up-to-date financial records demonstrate your business's stability and reliability to lenders. Ensure that your bookkeeping is meticulous, reflecting all transactions clearly. This transparency can bolster lender confidence, especially during uncertain economic times.

Build Relationships with Multiple Lenders

Diversifying your lender relationships can be advantageous when one source tightens its lending criteria. Establishing connections with multiple financial institutions can provide alternative funding options and improve your chances of securing credit.

Strategies to Strengthen Business Credit

Pay Bills on Time

Late payments can significantly impact your business credit score. Prioritize paying bills on time to maintain a favorable credit profile. Consider setting up automatic payments or reminders to avoid missing deadlines.

Reduce Credit Utilization

A high credit utilization ratio can be detrimental to your business credit score. Aim to keep your credit utilization below 30% by paying off balances promptly and avoiding unnecessary debt. This practice not only improves your credit score but also demonstrates fiscal responsibility.

- Negotiate better terms with suppliers

- Consider secured lines of credit

- Utilize trade credit cautiously

Conclusion

Navigating business credit during economic uncertainty requires proactive management and strategic decision-making. By monitoring your credit report, maintaining strong financial records, building relationships with multiple lenders, and adopting strategies to strengthen your credit, you can enhance your business's financial resilience. Ultimately, a robust credit profile serves as a foundation for stability and growth, even in challenging economic climates.